Unlocking Forex Trading Opportunities in Malaysia

Unlocking Forex Trading Opportunities in Malaysia

Forex trading has emerged as a popular financial market in Malaysia, allowing traders to exchange currencies and capitalize on price fluctuations. With a growing number of participants, understanding the intricacies of forex trading has never been more critical. Aspiring traders in Malaysia can explore various platforms and services to maximize their trading efforts. For those interested in learning how to navigate the world of forex, forex trading malaysia Forex Brokers in Côte d’Ivoire can be a reference point illustrating the factors to consider when choosing a broker.

Understanding the Forex Market

The forex market, or foreign exchange market, is the global arena for trading national currencies against one another. It is decentralized and operates 24 hours a day, five days a week, making it accessible to traders worldwide, including those in Malaysia. Participants include banks, financial institutions, corporations, governments, and individual retail traders.

Why Forex Trading is Popular in Malaysia

In recent years, forex trading has gained tremendous traction in Malaysia for several reasons:

- Accessibility: The forex market is highly accessible, offering low entry barriers compared to other financial markets. Traders can open accounts with a relatively small amount of capital.

- Leverage: Forex brokers provide significant leverage, allowing traders to control larger positions than their initial capital would permit.

- Diverse Trading Options: The forex market offers numerous currency pairs, creating diverse trading opportunities based on global economic events.

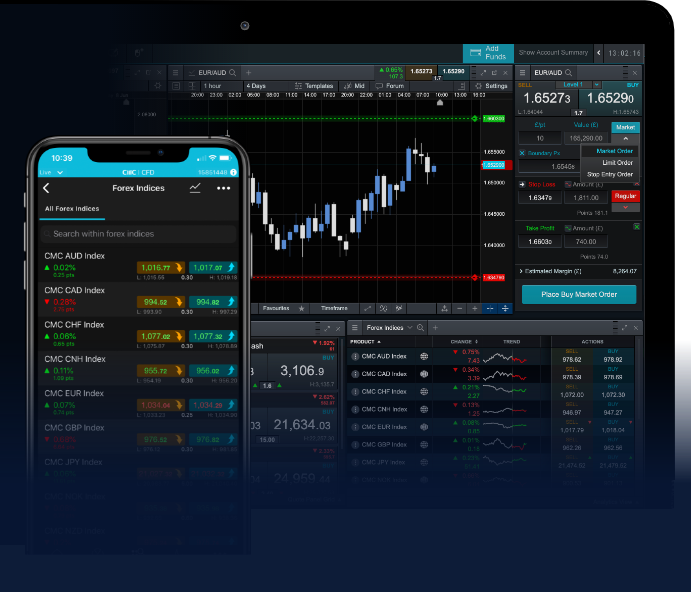

- Technological Advances: Online trading platforms and mobile applications facilitate easy and convenient trading from anywhere at any time.

Choosing a Forex Broker in Malaysia

Choosing the right forex broker is crucial for success in trading. Here are several factors to consider when selecting a broker in Malaysia:

- Regulation: Ensure that the broker is regulated by recognized bodies, such as the Securities Commission Malaysia (SC) or the Labuan Financial Services Authority (LFSA).

- Trading Fees and Spreads: Evaluate the broker’s fees, spreads, and commissions to understand how they impact your profitability.

- Trading Platform: A user-friendly and reliable trading platform can significantly influence your trading experience. Test it using a demo account before committing to a live account.

- Customer Support: Reliable customer support is essential, especially for new traders who may need assistance navigating the trading environment.

Popular Forex Currency Pairs

Traders in Malaysia often focus on several key currency pairs, including:

- EUR/USD: The Euro against the US Dollar is the most traded currency pair globally and offers high liquidity.

- USD/JPY: The US Dollar against the Japanese Yen is also popular, particularly among Asian traders.

- GBP/USD: The British Pound against the US Dollar is favored due to its volatility and potential for profit.

- AUD/USD: The Australian Dollar against the US Dollar is significant for traders focused on commodity-related currencies.

Strategies for Forex Trading

Implementing effective trading strategies can significantly enhance your chances of success in forex trading. Some popular strategies include:

- Day Trading: This strategy involves opening and closing positions within the same trading day to capitalize on intraday price movements.

- Swing Trading: Swing traders hold positions for several days or weeks to benefit from price trends.

- Scalping: Scalping is a short-term strategy focusing on small price changes, requiring quick decision-making and execution.

- Trend Trading: This involves analyzing market trends to identify potential entry and exit points based on the direction of price movements.

Risk Management in Forex Trading

Risk management is vital in forex trading, where market volatility can lead to considerable losses. Here are some essential risk management tips:

- Set Stop-Loss Orders: Use stop-loss orders to automatically close positions at predetermined price levels, limiting potential losses.

- Position Sizing: Adjust the size of your trades based on your account balance and risk tolerance to manage exposure.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade or currency pair to spread risk across different assets.

- Regularly Review Your Trades: Analyze past trades to understand what worked and what didn’t, continuously refining your trading approach.

Conclusion

Forex trading in Malaysia offers a wealth of opportunities for traders keen to navigate the global currency markets. As you embark on your trading journey, ensure that you equip yourself with the necessary knowledge, choose the right broker, and implement sound risk management strategies. By doing so, you can position yourself to take advantage of the benefits that forex trading has to offer while minimizing potential pitfalls.

With the right education and an understanding of market dynamics, traders in Malaysia can achieve substantial success in the forex market. Whether you are a novice or an experienced trader, staying informed and responsive to market changes is key to unlocking the full potential of forex trading.

コメントを残す